As inflation rises and traditional assets deliver mixed results, investors are searching for alternative income-generating strategies. For those willing to think outside the box—and sometimes on wheels—RV rental management is quickly becoming one of the most overlooked yet lucrative opportunities.

But is it just another side hustle? Or is it a real, scalable asset class?

This article explores the RV rental management model from an investor’s lens. Whether you’re a real estate investor, a retired entrepreneur, or simply someone looking to diversify income streams, here’s what you need to know about treating RVs as income-producing investments.

Table of Contents

- The Rise of RV Rentals: Market Context and Growth

- How RV Rental Management Works for Investors

- Comparing RVs to Other Asset Classes

- Passive vs. Active Investment Options

- What Makes a Profitable RV Unit

- Real Returns: Revenue Models and Examples

- Tax Advantages and Depreciation

- Risks, Mitigation, and Scalability

- Final Take: RVs as Rolling Real Estate

1. The Rise of RV Rentals: Market Context and Growth

RV travel has surged post-2020, driven by remote work, outdoor lifestyle trends, and the appeal of flexible, socially distanced vacations. Platforms like Outdoorsy, RVezy, and RVshare report record-high bookings, and many RVs in rental programs are now booked out months in advance during peak season.

RV Management USA (RVM) and similar management models are bringing professionalism to this once-fragmented space—turning RVs into bookable, revenue-generating assets with real structure and predictable returns.

2. How RV Rental Management Works for Investors

The typical model looks like this:

- Investor purchases an RV (or multiple units)

- RVM handles everything: listing, booking, pricing, renter screening, cleaning, and insurance

- A local Territory Manager (TM) manages on-the-ground operations

- Revenue is split: 45% to investor, 45% to TM, 10% to RVM

This structure allows investors to earn without needing RV experience, property management tools, or weekend availability.

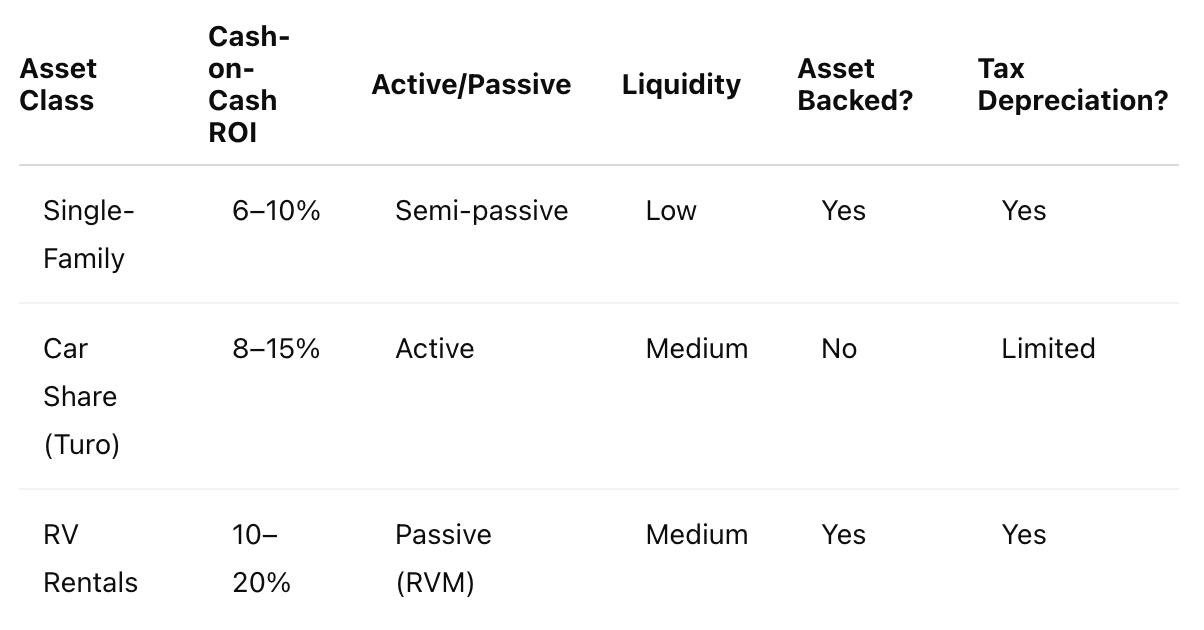

3. Comparing RVs to Other Asset Classes

RVs strike a rare balance between high ROI, manageable entry cost, and asset backing—particularly when paired with a professional rental system.

4. Passive vs. Active Investment Options

You can self-manage your RVs, just like real estate. But with rental logistics, maintenance, and marketing, returns come with heavy time involvement.

With RVM, investors:

- Don't talk to renters

- Don't manage bookings

- Don't clean or inspect RVs

The result: true passive income with clear monthly reporting and retained ownership.

5. What Makes a Profitable RV Unit

The most successful investment RVs are:

- Class C or travel trailers (under 5 years old)

- Sleeping 5–8 guests comfortably

- Located in high-demand travel areas

- Equipped with family-friendly features (bunks, slide-outs, outdoor kitchens)

Consistency and quality matter. Units with poor layouts, minimal storage, or high maintenance issues underperform—even in strong markets.

6. Real Returns: Revenue Models and Examples

Example 1 – Travel Trailer (Arizona)

- Purchase price: $40,000 (used)

- Gross annual bookings: $18,000

- Investor share (45%): $8,100

- Loan payments: $3,600/year

- Net profit: $4,500–$5,000/year

Example 2 – Class C Motorhome (Colorado)

- Purchase price: $80,000 (used)

- Gross bookings: $26,000/year

- Investor share: $11,700

- Loan payments: $6,500/year

- Net profit: $5,000+ with asset value retained

These numbers improve with strategic financing, multi-unit scaling, and RVM-led optimization.

7. Tax Advantages and Depreciation

RVs are eligible for accelerated depreciation under U.S. tax law if used in a business (such as rentals). Investors may deduct:

- Depreciation (Section 179 and bonus depreciation)

- Loan interest

- Insurance and storage

- Maintenance costs

This means investors can reduce taxable income significantly in the early years—enhancing real returns.

Always consult a tax advisor to structure your deductions properly.

8. Risks, Mitigation, and Scalability

Risks:

- Seasonal demand fluctuations

- Wear and tear

- Maintenance surprises

- Insurance claims

Mitigation:

- Use RVM for preventive maintenance and TM oversight

- Keep units newer than 5 years old

- Diversify by geography or unit class

- Leverage off-peak bookings through delivery add-ons

Scalability:

Many investors use one unit to test the model, then reinvest into 2–3 more by year two. Others manage RVs for friends and family for a 10–20% override.

9. Final Take: RVs as Rolling Real Estate

RV rental management is no longer a hobby—it’s a maturing, high-yield asset class with solid fundamentals.

With the right vehicle, the right management team, and the right strategy, investors can:

- Earn double-digit returns

- Retain flexibility of asset use

- Tap into strong travel demand

- Build a diversified income stream

For investors who like cash flow, asset backing, and low entry barriers, RVs might just be the most exciting vehicle in your portfolio.

– RVM Team